In the modern era, we have access to more information than ever before. The phone in your pocket is an encyclopaedia of knowledge and an increasing number of people are turning to the internet for advice about their wealth.

According to Nasdaq, almost 80% of young adults turn to social media for financial help and 62% of them feel empowered by having more access to information. But you may want to be careful about the advice you follow because there are a lot of common money myths out there.

Making decisions based on misinformation could harm your long-term financial plan but luckily, it’s easy to stay informed when you work with an experienced financial planner.

These are five of the most common money myths you may need to watch out for.

1. “You should check your investments daily”

Investing your wealth may help you to increase it and give yourself a barrier against inflation. However, many people mistakenly think that they need to check their investments daily and try to “time the market” to maximise returns.

In reality, constantly checking the stock market only encourages emotional investing – making rushed decisions based on fear and panic, rather than following a financial plan built around your goals.

Indeed, you may be more likely to see a positive return if you adopt a long-term strategy and hold your nerve during times of turmoil instead, as historical stock market data illustrates.

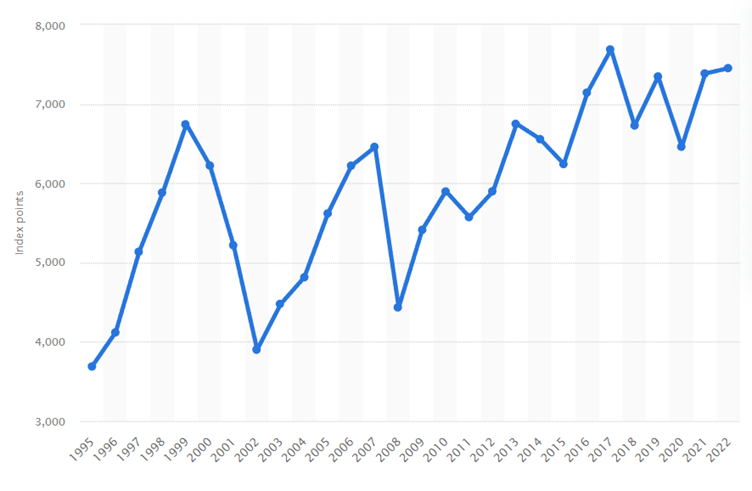

Consider the historical performance of the FTSE 100, for example:

Source: Statista

As you can see, the value of the index increased substantially between 1995 and 2022, and if you invested during this time, you may have seen positive returns. But in that period, there were multiple market upsets like the 2000s dotcom bubble and the 2008 financial crisis, which caused the value to significantly drop.

Had you been checking your investments daily and allowed these events to cloud your judgment, you may have sold your investments, ultimately missing out on significant future returns.

2. “Paying off your mortgage early isn’t worth it”

Being mortgage-free may be a key financial goal for you, but there are those who maintain that paying off your mortgage early isn’t necessarily worth it.

The thinking behind this is that, if your mortgage interest rate is lower than your likely return from the stock market, it makes more financial sense to invest any additional funds instead. However, depending on your mortgage and your financial situation, there may be significant benefits to overpaying your mortgage.

Your monthly payment is determined by the:

- Principal amount you borrowed

- Interest rate

- Term of the loan.

By overpaying, you can clear the principal amount faster and reduce the term of the loan, thereby reducing the overall amount of interest that you pay.

These savings can be significant, as figures from NatWest demonstrate. They estimate that if you have a mortgage of £150,000 with 20 years left of the term, and a 4% interest rate, your current monthly payments would be £909.

If you overpay by £50 a month, you could potentially reduce the term by 18 months and save a total of £5,807 in interest, provided the rate stayed the same. Overpaying by £100 a month could take almost three years off the term and save you £10,677 in interest.

Though you may see comparable returns from the stock market, the returns from overpaying your mortgage are more reliable. Additionally, you free up more capital once you pay the mortgage off, which you could then invest or contribute to your pension.

There is also a strong emotional element involved because paying off your mortgage can give you a sense of financial freedom and security, which is a really great feeling!

That said, it is important to check whether you will face early repayment charges as this may mitigate some of the benefits of paying off your loan early.

3. “Credit is bad”

Conversations about credit are often very negative but, while it is important to borrow responsibly, it is a myth that credit is always a bad thing.

When used in the right way, credit can help you improve your borrowing options in the future, provided you make repayments on time. It can also be useful for spreading out large purchases to make expenses more manageable, and you may be able to use credit to help you achieve long-term financial goals. For example, you could take out a home improvement loan to do work on your home, which may increase its value in the future.

Additionally, Section 75 of the Consumer Credit Act protects credit card purchases between £100 and £30,000 and makes the credit card company equally liable with the seller if there is a problem. This may mean that you have more recourse for claiming money back than you would if you made a purchase on a debit card.

So, although credit can be negative when mismanaged, if you borrow sensibly and for the right reasons, it can be a useful tool.

4. “’Common law marriages’ protect your assets”

Research from the government shows that 46% of people believe that cohabiting couples automatically have the same rights as married couples or those in a civil partnership. However, this idea of a “common law marriage” is a myth and it is important that you don’t miss out on important protection because of it.

If you are not married or in a civil partnership, you likely have no automatic rights to inherit anything from your partner when they pass away, and they may not necessarily inherit your estate either. Additionally, they have no automatic right to make decisions on your behalf or access your finances should you fall ill or sustain a serious injury.

That’s why it’s important that you put a will and Lasting Power of Attorney (LPA) in place to choose who looks after your affairs and how to divide your assets if the worst does happen.

5. “Financial advice only benefits the extremely wealthy”

Some people believe that financial advice only benefits extremely wealthy people with huge sums of money to invest in the stock market, but that simply isn’t the case.

Everybody has long- and short-term financial goals and regardless of your earnings, you could benefit from advice on aspects of your wealth such as savings, investments, and retirement planning. No matter how wealthy you are or what stage of your life you are at, financial advice can help you achieve the lifestyle you want, and statistics reflect that.

Indeed, a study from Royal London found that 63% of people who took advice said they felt financially secure and stable, compared with 48% of people who didn’t.

Most importantly, this trend is the same in higher income households with a total income over £70,000 and lower income households who collectively earn less than £70,000 a year.

Get in touch

Many people believe these common money myths which can harm your long-term financial stability. So, if you want to make the most of your wealth, we can steer you in the right direction.

Email hello@fcadvice.co.uk or call 0330 828 4714 to learn more today.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Buy-to-let (pure) and commercial mortgages are not regulated by the FCA.

Think carefully before securing other debts against your home.

The Financial Conduct Authority does not regulate estate planning, tax planning or will writing.